Effective Business 101: Rent Your Own Advisory Board

If you were to identify, source and hire your own board of advisers with an experienced board chair and write a board charter with letters of engagement, it would likely be an expensive and arduous process inherent with risk.

You can end up wasting a lot of time focussing on who will be on your board, rather than on what expertise you really need.

But what if you could handpick a board of advisers and rent them on a 3-month basis? This board, made up of experts in their field, become your trusted resource and sounding board for overcoming the biggest roadblocks to the growth of your business.

Most business owners hire expensive consultants when they need outside help to improve their business.

Usually, consultants are skilled at solving one problem at a time—and you need multiple consultants to solve multiple problems at one time to eventually achieve target revenue growth objectives.

The last thing you want to be doing is spending your valuable time managing—sometimes even “babysitting”—consultants, whose goals include maximising their time in solving your challenges, so they can bill you for it. A carefully selected advisory board that is customised to your business truly cares about your success and has no hidden agendas, which gives you significant leverage over your competition.

Renting your own board of advisers gives you a dedicated and experienced group of the very best business experts who are authorities in their own subject areas. Your advisory board members will be specifically selected based on their skills, knowledge and experience relative to your strategic objectives.

Here Are The Top 5 Reasons You Win With Renting Your Own Advisory Board:

- The work of selecting your board members is done for you by experts

- Your board can be assembled quickly, usually within a week

- A three-month trial period eliminates financial risk

- Effective dynamics and processes maximise strategic impact

- An ROI/Scorecard Measurement evaluates your board’s efficiency

An advisory board is much more than just a group of experts sharing ideas—they are an extension of your business, integrating into your brand, your organisational chart and your leadership team. They become your personal board of mentors.

So ride the latest business wave of what works well in improving profitability and performance and rent your own advisory board!

Advisory Boards Vs. Boards Of Directors

In many organisations, it’s common practice to have a board of directors. Recently, a trend has started towards having an advisory board, especially for SMEs that are family-owned or start-ups.

I’m often asked the questions, “How is an advisory board different from a board of directors?” and “When should I think about using an advisory board?”

Here are some of the key differences between the two boards:

- An advisory board is not responsible for the running of your organisation and is not regulated under legislation (Corporations Act) or corporate governance codes for your country. Advice from an advisory board is nonbinding guidance—the members bear no fiduciary or legal responsibility for their words of wisdom.

- Advisory board members are not formal directors of your organisation in the traditional sense—they do not serve a governance function or represent shareholders or other stakeholders. They have no authority to act on behalf of the organisation.

- Advisory boards are not there to tell you how to do things—they are unable to issue directives. The members are there to ask questions that you hadn’t thought of asking and expand conversations, so you can be more strategic in your business planning.

An added benefit to having an advisory board is it can double as a “test run” for potential formal directors. The members are familiar with the organisation, its strategic objectives and key people, and the quality of their contribution has already been established. What’s more, they can usually contribute sooner to formal board discussions faster than an “outsider.”

Advisory boards are made up of independent experts who provide high-quality, objective, strategic advice to business owners and leaders. This outside advice is especially helpful for smaller organisations, since they may not be able to afford the costs associated with a formal board of directors or an extended consulting relationship.

Depending on its specific purpose, an advisory board can have a broad focus or a narrower one. For example, will the advisory board be concerned with overall organisation strategy and enhancements, or are the advisers providing their experiences on a specific program and how it may be improved?

As far as when to use an advisory board, the short answer is as much as possible! Some of the situations that could benefit from an advisory board are:

- Guiding startup companies in a rapid growth phase

- Creating a new product line

- Moving into a new market segment or industry

- Moving into a new geographic area

- Making the transition from private to public and perhaps listing on a stock exchange

- Restructuring and repositioning a company in the market

- Implementing major new technology within the organisation

- Staving off a serious competitive threat

- Analyzing a potential takeover target*

Whatever your business needs are, I encourage you to consider forming an advisory board. You and your business will benefit from the members’ experience and wisdom!

*List courtesy of Australian Institute of Company Directors

Top 5 Reasons To Build A Board Of Directors

- Boards Drive Performance.

- Boards Promote Accountability.

- Boards Extend Networks.

- Boards Lend Credibility.

- Boards Provide Air Cover.

Boards drive performance by forcing clarity about strategy and direction. They make the company prioritise initiatives and resources to achieve critical goals in a timely fashion. They eliminate distraction and encourage momentum in profitable directions.

Boards promote accountability and discipline across your organisation. They provide a critical sounding board to test ideas, initiatives and strategies and prevent the “Emperor Has No Clothes” syndrome. Everybody has to report to somebody, and the board helps reinforce accountability and urgency.

Boards extend your connections and access to places and people you can’t reach. They help you see the unseen, explore unknown territory and provide a litmus test on risk.

Board members lend credibility to customers, associates and stakeholders. With a board, people know you are serious and professional—it raises your credibility in the marketplace.

Boards untangle interpersonal challenges among team members, family and equity shareholders. They provide “air cover” to the CEO for tough decisions (“The Board recommended…”). They can help reconcile differences between management and shareholders, particularly with regard to resource allocation.

The Verdict Is In! Boards Increase Profitability

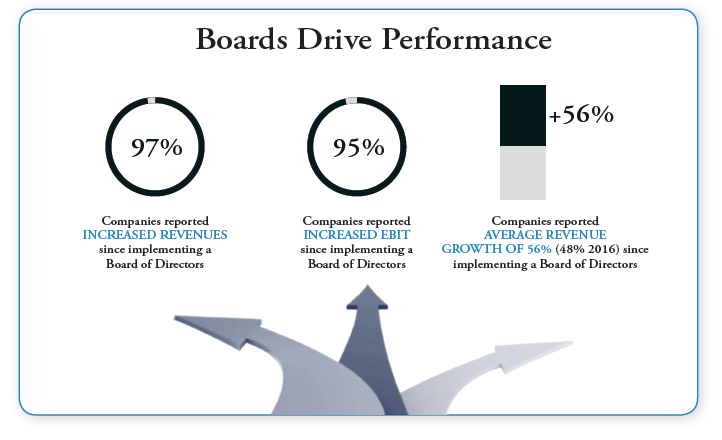

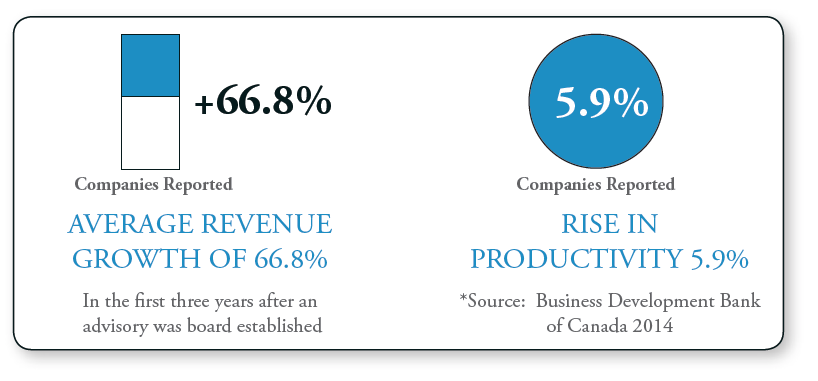

Strategic consulting firm Lodestone Global, in their 7th annual Private Company Board Compensation Survey for 2017-2018, found that boards increase the financial profitability of a company, with 97% of companies reporting increased revenues and 95% reporting increased EBITA after implementing a board.

Lodestone Global surveyed 386 companies across 32 different industries and 43 countries to analyse current board practices and compensation around the world. Thirty percent (30%) of respondents were from companies based outside the United States, with every continent but Antarctica represented.

All respondents were members of the Young Presidents’ Organization (YPO), an international group of Presidents and CEOs. The organization unites approximately 24,000 business leaders across 133 countries. All respondents were directors of companies with median revenues of $100m and 250 employees.

Since implementing a board of directors, companies reported an average revenue growth of 56% in 2017, up from 48% in 2016. Sixty percent (60%) of the companies in the survey had women as board members, up from 57% in 2016.

Approximately 98% of boards with at least one woman director reported that their companies increased revenues. These findings support previous public company research which contended that companies in the Fortune 500 with the highest representation of women directors attained higher financial performance, on average, than those with the lowest representation.

The survey also found that 52% of the participants categorised their boards as “indispensable” or “very effective” at driving corporate strategy. These results support the notion that a board, particularly with the right directors, can be essential to achieving corporate goals and improving profitability.

For more on the survey results, visit: https://www.lodestoneglobal.com/reports